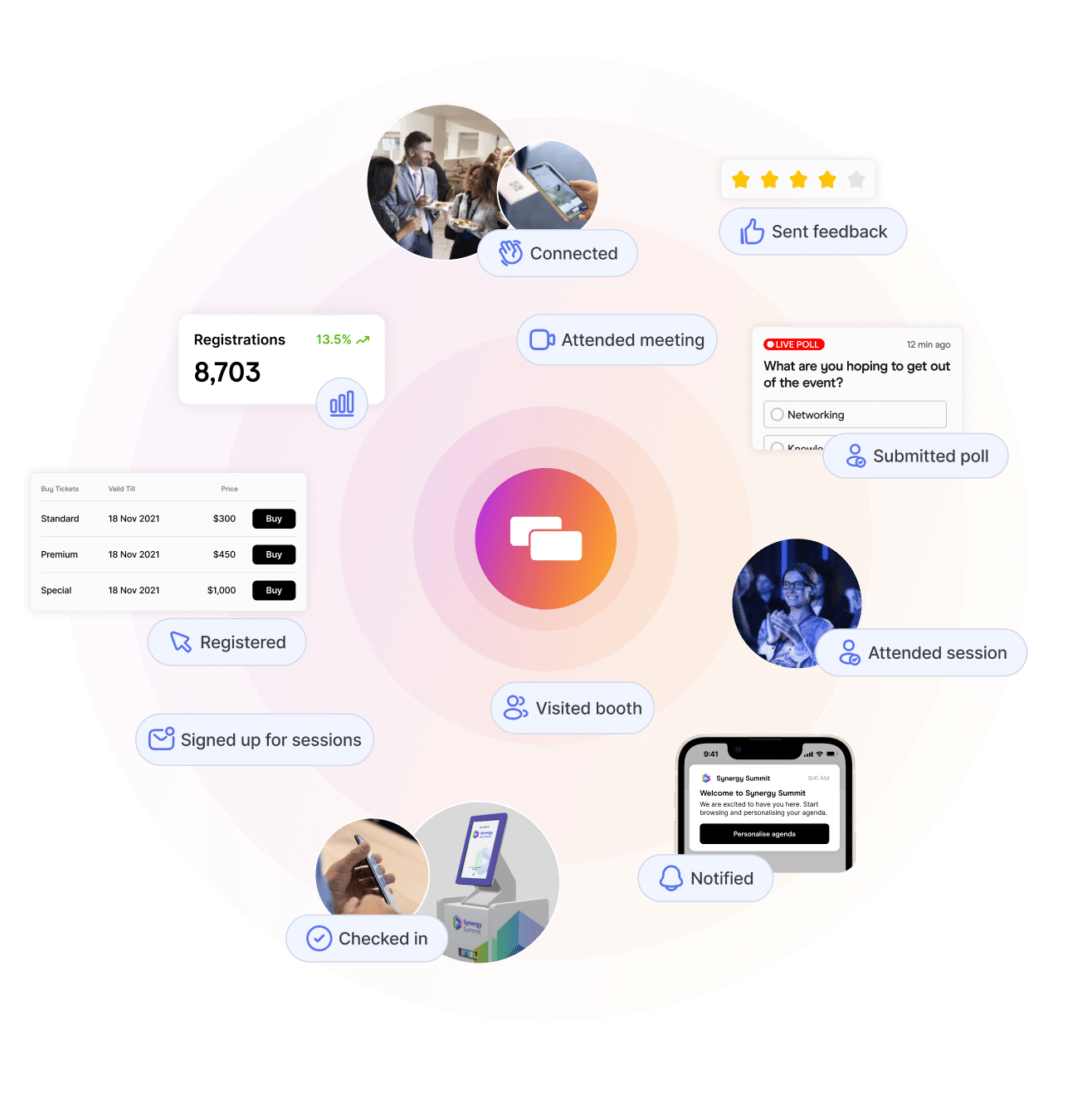

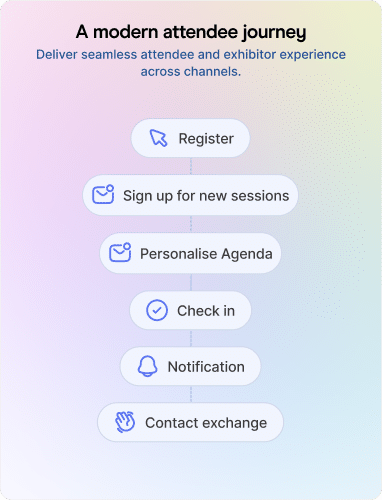

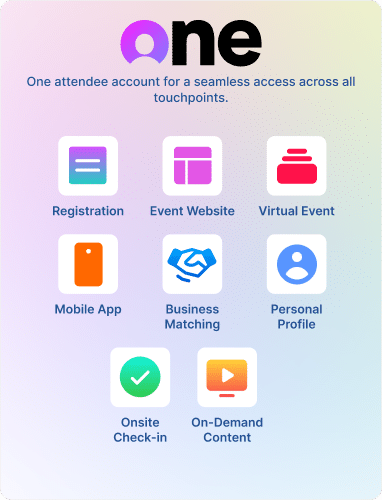

Omnichannel

Event Management Platform

Deliver unified event experience across all attendee touchpoints.

Event teams from leading organisations trust Gevme

Empowering event teams to deliver great events through technology & data

Singapore Fintech Festival

Organisers

Monetary Authority of Singapore, Elevandi, Constellar

Editions

2021, 2022, 2023

Solutions

RegistrationOnsite Check-in

The largest FinTech festival in the world and a knowledge platform for the global FinTech community.

Tech Week Singapore

Organisers

Closer Still Media

Editions

2023

Solutions

RegistrationOnsite Check-in

Asia’s most important technology event for business.

Geo Connect Asia

Organisers

Montgomery Group

Editions

2021, 2022, 2023

Solutions

Registration Onsite Check-in Virtual

The regional meeting place for the fast expanding geospatial, positioning, digital construction and remote sensing markets.

Tyrexpo Asia

Organisers

Tarsus Group

Editions

2023

Solutions

Registration Onsite Check-in Virtual

Bringing together highly-engaged and motivated buyers and sellers.

Industrial Transformation Asia-Pacific

Organisers

Hannover Messe

Editions

2021, 2022, 2023

Solutions

Registration Onsite Check-in Virtual

A strategic platform led by industry leaders and experts, uniting players and stakeholders to network and exchange knowledge for business success.

Forbes Global CEO Conference

Organisers

Forbes Asia

Editions

2023

Solutions

Registration Virtual

A prestigious annual event that gathers prominent CEOs, business leaders, and visionaries from around the world.

Singapore Convention Week

Organisers

Singapore Ministry of Law

Editions

2022, 2023

Solutions

Registration

Bringing together a diverse array of international conventions, conferences, and forums in one dynamic week-long gathering.

Retail Executive Summit

Organisers

Closer Still Media

Editions

2022, 2023

Solutions

Registration Onsite Check-in Virtual

Uniting distinguished executives, visionaries, and pioneers in the retail sector.

Wit Conference

Organisers

North Star Travel Group

Editions

2021, 2022

Solutions

Registration Onsite Check-in Virtual

Navigating the Future of Travel and Technology

Amazon Partner Event

Organisers

AWS

Editions

2022

Solutions

Registration Onsite Check-in

Designed to engage IT directors, developers, practitioners and business decision makers.

Herbalife Extravaganza

Organisers

Herbalife

Editions

2020, 2021, 2022

Solutions

Registration Virtual

Bringing together a vibrant community of individuals passionate about health, wellness, and personal growth.

Decarbonisation for Business

Organisers

Carbon Trust

Editions

2023

Solutions

Registration

Carbon Trust Leading the Way

Dinner & Dance

Organisers

Olam

Editions

2022

Solutions

Registration Onsite Check-in Virtual

Nurturing Global Agricultural Sustainability

Singapore Defence Technology Summit

Organisers

Defence Science & Technology Agency

Editions

2021, 2023

Solutions

Registration Virtual

A testament to the nation's commitment to advancing its defence capabilities through innovation, collaboration, and cutting-edge technology.

Operational Tech Cybersecurity Expert Panel

Organisers

Cyber Security Agency

Editions

2022, 2023

Solutions

Registration Onsite Check-in Virtual

Safeguarding Singapore's Critical Infrastructure

National Day Rally

Organisers

Prime Minister’s Office

Editions

2023

Solutions

Registration Onsite Check-in

A Visionary Address Shaping Singapore's Future

Stack

Organisers

GovTech

Editions

2022, 2023

Solutions

Registration Onsite Check-in Virtual

Building Bridges in the World of Technology

How Gevme empowers you

Enterprise Grade Security & Data Protection

At Gevme, data security and privacy are paramount. This is reflected in our compliance with regulatory requirements, including ISO 27001, ISO 27017, ISO 27018, and SOC2 Type 2.

“We had a great experience working with Gevme on the BestCities Global Forum. For us it was the first time to run this event completely online and adding hybrid components.”

Lesley Williams

Managing Director, BestCities

“Working with a tech partner is as much about the people as it is about the tech. Like us, Gevme is willing to push boundaries and try new stuff.”

Yeoh Siew Hoon

Founder, WiT

“Gevme provided us a seamless, all-in-one event solution that brings about a better event experience for our participants.”

Jessica Cheam

Managing Director, Eco-Business

“Huge thank you to the Gevme team for coming together to pull this off for us and for being nimble and agile with all the changes leading up to the event.”

Elane Noor

Executive Producer, Jack Morton Worldwide

“Carbon Trust needed a platform to facilitate the registration process and attendee management for a 2-year decarbonisation training programme. We partnered with Gevme who has constantly been adept at meeting our requirements.”

Jiao Xin Ping

Senior Analyst

“Gevme has been a great technology partner. They are able to follow our creative vision and come with solutions on integrating and designing the perfect client journey, whether for an internal meeting or a customer-facing event.”

Alexis Lhoyer

Co-Founder, Chab Events and Chab Lab

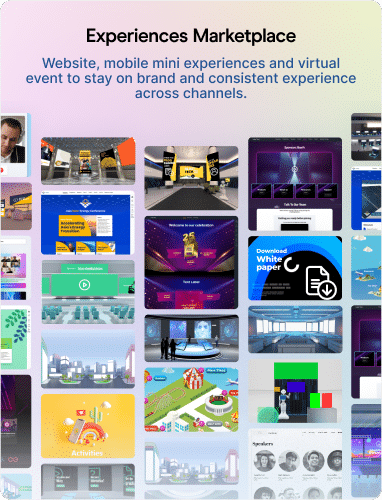

Explore the Gevme platform

Registration

Website

Onsite

Business Matching

Engagement

Virtual

Mobile App

Exhibitors & Sponsors

Integrations

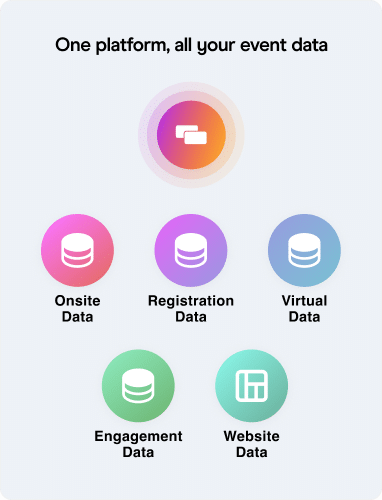

Unified Event Data

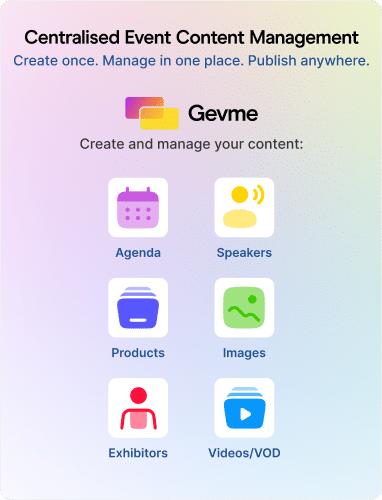

Centralised Event Content Management

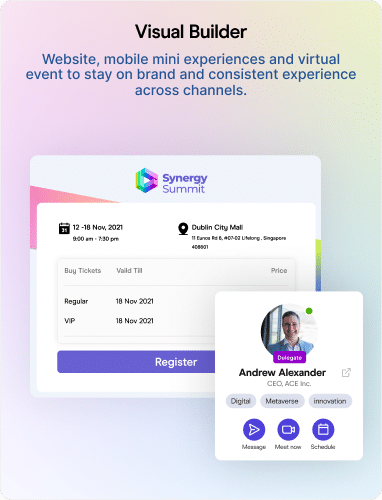

Visual Builder

Awards & Recognition

How can we empower you?

Whether you are a Professional Conference Owner or a Business Event Planner, deliver unified event experiences across all attendee touchpoints

- Attendees Privacy

- Attendees Terms

- Privacy Policy (Client)

- Terms of Use (Client)

- Privacy Policy (Visitors)

- ©2024 Gevme. All Rights Reserved